Now owning your first home could become a reality sooner than you think. The Government’s First Home Super Saver (FHSS) scheme means eligible first home buyers can use their super to help save for a deposit.

Saving faster with the First Home Super Saver scheme

Find out if you're eligible

Make extra contributions

Apply to withdraw

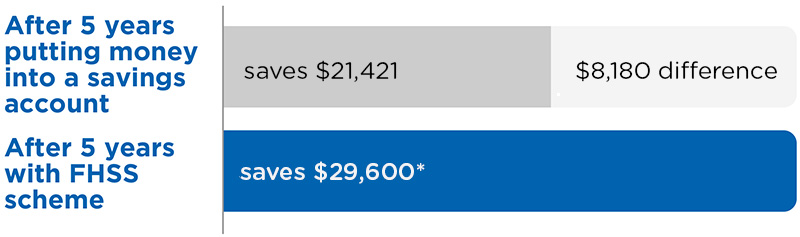

How Carly saved an extra $8,180 with the FHSS scheme

| Carly contributed $6,000 per year to her super under the FHSS | After 5 years of contributing via FHSS, she saves $29,600 | By saving via the FHSS, she saves an additional $8,180 to put towards her deposit |

| Extra contribution (using salary sacrifice) | Savings account | |

| Year 1 | $4,959 | $3,895 |

| Year 3 | $16,531 | $12,393 |

| Year 5 | $29,600 | $21,421 |